As a result of the ongoing coronavirus (COVID-19) pandemic, digital banking solutions are going to be essential if banks want to ensure continuity.

As we covered in our previous blog, once life returns to “normal”, consumers are going to be relying on those in banking more than ever before. From managing their finances to resuming longer-term investments, digital solutions are only going to bolster the relationship between business and consumer.

Digital solutions – such as online banking and apps for consumers, and virtual learning solutions for banking leaders and employees – will be crucial for improving operations and training programmes for banks.

Here at MDA Training, we have adapted our customer-centric banking training programmes to suit the needs of the remote workforce, providing e-learning, microlearning, and virtual training programmes to support development.

Cater to the needs of the remote workforce

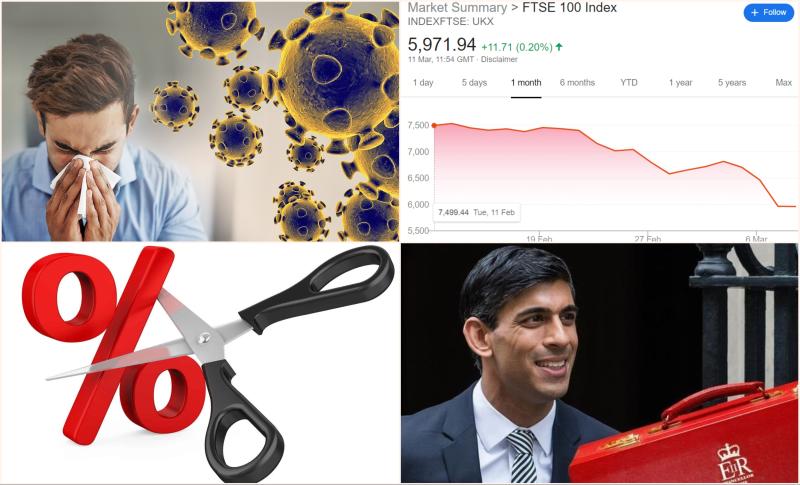

Much like every industry, banking was thrown a COVID-19-shaped curveball at the beginning of the year. As a result, many teams were forced to embrace an indefinite period of working from home.

Despite initial concerns, and a temporary slump in productivity, many are now benefiting from an increase in communication between themselves and others in the team.

Of course, this would not have been possible without adequate preparation. Naturally, the best banks would have had plans and operational processes in place to ensure the continuity of working life, even when faced with the added challenge of workers being apart.

Another thing to consider is the fact that employees are now expected to carry out their roles wholly online – from meetings (thanks to the increasing popularity of Zoom, Microsoft Teams and other software) to informal chats between colleagues.

The direct result of this is that learning, and personal development is also expected to be carried out digitally. Banks and leaders must take this into consideration, and utilise the best technologies available in order to help both workers and the business thrive.

Increasing consumer demands

By now, it is becoming apparent that the pandemic will have a long-term impact on consumer behaviours, and banking is no exception.

Thanks to the development of open banking and innovative apps, many financial services were already online before the outbreak of COVID-19.

Even before the pandemic started, a typical consumer would have expected to manage their finances purely online, without visiting a branch, let alone interacting with another person.

As Genpact highlighted in its recent instinctive enterprise report, banking is no stranger to adversity. In the past decade alone, the industry has faced the fallout of the financial crisis, new competitors (in the form of banking start-ups) and, now, a global pandemic.

With this in mind, banks need to be able to ensure that their employees can utilise emerging technologies – like AI, or business simulations – to enhance their learning and development, to maintain the highest level of service.

Flexibility in the workplace

In the modern workplace, there is no reason as to why banks shouldn’t be able to provide alternative forms of learning for their employees. If there is one thing that we have learnt from our years of experience, what works for one employee won’t necessarily work for another.

At a time like this, learning and development shouldn’t stagnate. Digital learning can provide employees with the opportunity to develop their skills at their own pace, at a time that is convenient for them.

Here at MDA Training, we are adapting our programmes to provide fully digital learning solutions for banks. From blending learning modules to standalone modules, we can deliver our training in a variety of formats, ranging from microlearning to digital workbooks and virtual learning. Our areas of expertise include:

- On-demand e-learning and microlearning

- Live virtual training modules on technical, industry, and professional skills

- Experiential film-making activities, to support leadership development and other assessments.

Throughout the coronavirus crisis, we are continuing to support workforces all over the world, as they have become accustomed to working from home.

From providing virtual training sessions to pioneering digital learning simulations, we’ve been able to enhance learning at home, for many banking employees.