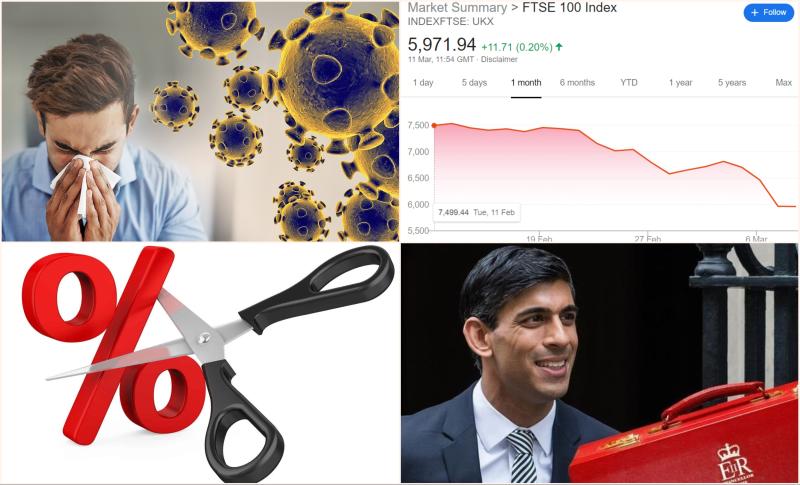

With many employees working from home amid global health concerns over the coronavirus, millions of people can expect to have their daily routines and work styles impacted.

Not everyone is accustomed to working from home, and getting into work a productive mindset from a space that’s not your regular one can be a huge adjustment.

There are advantages to working from home, not least the which is saving most of us from the daily commute (which most have come to loathe). But the challenges, including loneliness, staying connected, and more distractions can have a significant effect on your psyche and productivity.

At MDA Training, we are used to working remotely. Much of our training is delivered virtually, sometimes from our home, and due to the amount of travel involved in our industry, we encourage consultants to work from home if they have been away a lot. We have more experience than most perhaps in remote working.

Whether you’re are working from a spare bedroom, a coffee shop (my personal favourite), the library (maybe not the best if you have frequent calls or virtual meetings), or the lobby of your apartment building (I’ve seen that here in Hong Kong due to our small apartment size!), I’ve compiled some tips to help you get set up and virtually work like a professional, no matter where you are.

Make the most of your platform

Traditionally our company has used WebEx to deliver webinars and meet virtually, as have some of our large banking clients. Recently we have switched to Zoom. Your organisation will have its own virtual platform, either one of these or another.

Whichever platform you use, there are some great features that enable a sense of connectedness. File sharing, annotating screens, whiteboards, instant messaging, virtual breakout rooms and non-verbal feedback like emoticons are all very standard.

Rather than just using it as only a video conferencing tool, getting to know the features of whichever platform you are using will enhance your productivity and engagement, and those of others.

Your workstation

If you haven’t set up a proper workstation at home, you would miss the regular working environment. To deal with it, set up your home office just like your workplace to feel more connected to work. Working from your bed or sofa is not too ideal for ensuring productivity.

Your laptop will likely have a built-in camera and audio, but it makes a big difference in the experience for you and others in the meeting when you have a quality webcam and a good microphone.

I use a Logitech Brio Webcam and a set of Airpods for enhanced audio and video quality. Even a pair of wired mic-enabled headphones can go a long way. Lighting also is crucial. Sitting in a dark room with a bright light directly overhead will seriously impact the way people see you. If possible, try to have your face by natural light, like a nearby window or get a small webcam light.

Virtual backgrounds

As someone who regularly delivers webinars from home to investment banking clients, one of my best tips is to use a virtual background. When having a video conversation, a professional virtual background can help people get the needed professional impression from you.

Even blurring the background may be the most appropriate solution for your requirements – all of these features are usually available on video conferencing platforms.

Leverage in-meeting chat to share files & resources

I use in-meeting chat as a way to share links or resources that may be discussed in the meeting. For example, team members will share Microsoft office docs, URLs, or just quick comments (as to not disrupt ongoing conversations).

This is important as it goes a long way to replicate a lot of the informal conversations we have in our normal office environment.

Other work-from-home tips

Small breaks are important and built into our normal working environment, and it’s important to keep up similar routines at home. My main recommendation is to keep up your routine just as you would if going into an office. Doing all the things you do in the morning — brushing your teeth, showering, eating breakfast, etc. — will help you deal with the disruption many of us currently face.

Here are a few other work-from-home tips from myself and my colleagues at MDA Training:

- Dress for work – you should put on a shirt or outfit you’d normally wear to the office and not your sweat pants you wear when no one else is home

- Move about – stretch, take a lap around the house, stand at the kitchen bar and work from there for a while. Many of us will not have the ergonomically designed chair we are used to in the office which can have an impact on our bodies

- Communicate your availability – share your calendar, block off time for specific tasks, set reminders, and make sure you keep track of time. It’s easy to work through the time you made a commitment to start dinner

- Eliminate distractions as best you can – shut the door, or even hang a curtain to give yourself some privacy and separation

- Avoid isolation & loneliness – have daily team check-ins or arrange a virtual lunch with your team. Talk live or disable the audio and chat with the group or 1-on-1 privately, whatever helps you get the conversation and connection you need.